georgia ad valorem tax 2021

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. 2021 property tax bills 2021 property tax bills for the city of jasper will be mailed on friday november 12 2021.

2021 Property Tax Bills Sent Out Cobb County Georgia

A BILL to be entitled an Act to amend Part 1 of Article 2 of Chapter 5 of Title 48 of the Official Code of Georgia Annotated relating to property tax exemptions so as to provide for a state-wide exemption from all ad valorem taxes for timber equipment and timber products held by timber producers.

. Some of the taxes levied may not be collected for various reasons assessment errors insolvency bankruptcy etc. The property taxes levied means the taxes charged against taxable property in this state. The tax must be paid at the time of sale by Georgia residents or within six months of.

A mill is 110 of 1 cent or 1 per 1000 of assessed value. If itemized deductions are also. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session.

State Fiscal Year July 1 2021 - June 30 2022. Instead it appears to be a tax in the nature of a sales tax. The Georgia Department of Revenue assesses all vehicle values for tax purposes each year.

This calculator can estimate the tax due when you buy a vehicle. This tax is based on the cars value and is the amount that can be entered on Federal Schedule A Form 1040 Itemized Deductions for an itemized deduction if the return qualifies to itemize deductions rather than take the standard deduction. Use Ad Valorem Tax Calculator.

Updated April 6 2021. Provide homestead exemption. Local state and federal government websites often end in gov.

Georgia HB498 2021-2022 A BILL to be entitled an Act to amend Part 1 of Article 2 of Chapter 5 of Title 48 of the Official Code of Georgia Annotated relating to property tax exemptions so as to expand an exemption for agricultural equipment and certain farm products held by certain entities to include entities comprising two or more family owned farm entities to. The information on this page is intended to proved some basic information on the treatment of real estate taxes also known as ad valorem taxes in Georgia. The links below are reports that show the ad valorem taxes that were levied by local counties schools and cities for the indicated tax year.

The Georgia County Ad Valorem Tax Digest Millage Rates have the actual millage rates for each taxing jurisdiction. Assessments are by law based upon 40 of the fair market value for your vehicle. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address.

Local state and federal government websites often end in gov. Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and use tax and the annual ad valorem tax ie. The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate.

The Georgia Annual Ad Valorem Tax applies to most vehicles purchased prior to March 1 2013 and non-titled vehicles and qualifies as a Personal Property Tax. To provide for a referendum. The tavt rate will be lowered to 66 of the fair.

2022 Motor Vehicle Assessment Manual for TAVT 1392 MB 2021 Motor Vehicle Assessment. Georgia HB997 2021-2022 A BILL to be entitled an Act to amend Part 1 of Article 2 of Chapter 5 of Title 48 of the Official Code of Georgia Annotated relating to property tax exemptions so as to provide for a statewide exemption from all ad valorem taxes for timber equipment and timber products held by timber producers to provide for a referendum to. The TAVT rate will be lowered to 66 of the fair market value of the motor vehicle from 7.

GEORGIA DEPARTMENT OF REVENUE Local Government Services PTS-R006-OD 2020 Georgia County Ad Valorem Tax Digest Millage Rates Page 2 of 43 Mar 26 2021 1033 AM County District MO Bond BANKS SCHOOL 14511 BANKS STATE 0000 BARROW AUBURN - BARROW 4931 BARROW BETHLEHEM 0000 BARROW BRASELTON 0000 BARROW CARL 0000 BARROW CID. You will now pay this one-time. It is important for property owners to understand the tax and billing process since tax bills constitute a lien on the property on January 1st of each year.

The new Georgia Title Ad Valorem Tax TAVT is not deductible as a property tax as it is not imposed on an annual basis. Instead the purchased vehicles are subject to a one-time title ad valorem tax TAVT. The cutoff year for reduced TAVT rate 1 for older vehicles changed to 1989 so the reduced rate applies to any person who purchases a 1963 through 1989 model year motor vehicle.

A bill to be entitled an act to amend an act providing a homestead exemption from city of atlanta independent school district ad valorem taxes for educational purposes. 25 for every 1000 of assessed value or 25 multiplied by 40 is 1000. Georgia Motor Vehicle Assessment Manual for Title Ad Valorem Tax.

Thus the tax would be deductible on Schedule A of Form 1040 if you itemize as part of your state and local sales tax paid however if you choose to deduct sales tax. Historical tax rates are available. Sign in to TurboTax Online then click Deductions Credits Review or Edit.

In addition the State levies ad valorem tax each year in an amount which cannot exceed one-fourth of one mill 00025. School district ad valorem taxes. The State Revenue Commissioner is responsible for examining the tax digests of counties in Georgia in order to determine that property is assessed uniformly and equally between and within the counties OCGA.

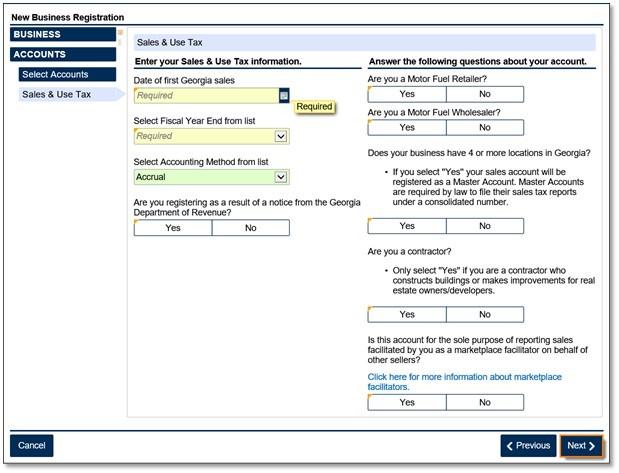

Motor vehicle dealers should collect the state and local title ad valorem tax fee TAVT from customers purchasing vehicles on or after March 1 2013 that will be titled in Georgia. Payment of the TAVT provides an exemption from sales tax on the motor vehicle and the purchaser will also be exempt from the annual ad valorem tax or. To enter your Personal Property Taxes take the following steps.

We are excited to implement Senate Bill 65 which ultimately reduces the. March 17 2021 513 PM. When we publish the millage rate we are describing the number of mills.

TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles. For the answer to this question we consulted the Georgia Department of Revenue. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address.

In a county where the millage rate is 25 mills the property tax on that house would be 1000. This tax is based on the value of the vehicle.

Georgia Revenue Primer For State Fiscal Year 2022 Georgia Budget And Policy Institute

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota States

Property Taxes Laurens County Ga

Tax Rates Gordon County Government

Georgia Sales Tax Small Business Guide Truic

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Marketplace Facilitators Georgia Department Of Revenue

Michigan Property Taxes By County 2015 Property Tax Georgia Properties Home Icon

Property Overview Cobb Tax Cobb County Tax Commissioner

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Georgia Used Car Sales Tax Fees

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Pin By Melissa Shortt On Aveda Oconee Embarcadero Aveda

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes